unified estate and gift tax credit 2021

It increased to 11206 million in 2022. In other words the donor of a gift is not required to pay any gift tax on the money paid in gift tax.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

2021 federal estate tax exemption It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDFThe fair market value of these items is used not necessarily what.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)

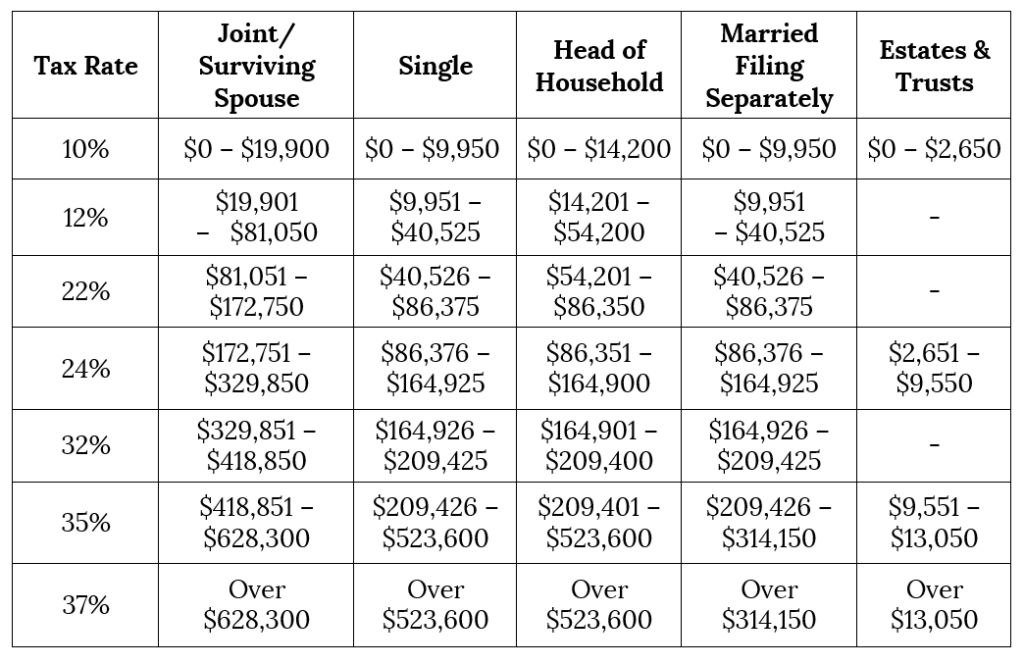

. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. In Revenue Procedure 2021-45 RP-2021-45 irsgov the Internal Revenue Service announced annual inflation-adjusted tax rates for 2022 including provisions concerning estate and gift taxes. This credit is significant as amounts above this level will be taxed at rates starting at 18 and gradually increasing to 40 as of 2020 based on the size of the estate.

The lifetime exemption was worth 117 million for tax year 2021. The previous limit for 2020 was 1158 million. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified.

For 2021 that lifetime exemption amount is 117 million. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. As of 2021 you are able to give 15000 per year to any individual as a tax-exempt gift.

The estate and gift taxes are based on a series of graduated rates that start at 18. The tax is then reduced by the available unified credit. This is called the unified credit.

In 2022 the combined credit against estate and gift tax will be 12060000 an increase from 117 million dollars in 2021 according to the IRS. Gifts above the 16000 per giver amount will reduce the lifetime gift and estate exemption by the amount over 16000. In other words use it or lose it.

What is the unified tax credit for 2022. Beginning in 2022 the annual gift exclusion will be 16000 per donor an increase over the previous years 15000 limit. The unified credit is per person but a married couple can combine their exemptions.

The unified credit against estate and gift. Gift and Estate Tax Exemptions The Unified Credit Then there is the exemption for gifts and estate taxes. Instead all of those funds pass directly to the specified recipients.

The Unified Tax Credit represents the amount of assets that an individual is allowed to gift to other parties without having to pay gift estate or generation-skipping transfer taxes. As of 2021 married couples can exempt 234 million In 2022 couples can exempt 2412 million. Unified tax credit strategies.

This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being applied. Do this for 10 years and youve given away 15 million without paying gift taxes or reducing your unified limit. However each person is allowed a unified credit that eliminates the.

A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. This means that you can give 15000 every year to each of your 10 children without being subject to gift taxes on that 150000. Gifts and estate transfers that exceed 1206 million are subject to tax.

A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system. Any tax due is determined after applying a credit based on an applicable exclusion amount. The extent of the benefit provided by the unified tax credit depends on the tax year in which you intend to use the credit.

This year they could give each child a combined 32000 without triggering the gift tax. If you need more information about the unified tax credit use our free legal tool below. And you can use it to defray the tax burden of giving more than the annual gift tax exclusion to any individual in a given year.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. A key component of this exclusion is the basic exclusion amount BEA. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due.

For 2021 the estate and gift tax exemption stands at 117 million per person. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. For 2021 the estate and gift tax exemption stands at 117 million per person.

For example if you are a single individual and you gift 595000 to your child in 2020 then you have made a taxable gift of 580000 ie the amount by which 595000 exceeds the 15000 Annual Exclusion and you will therefore use 580000 of your Unified Credit to avoid paying the gift tax. Annual Gift Tax Exclusion In 2022 you can gift up to 16000 per year to as many people as you wish without having to notify the IRS except in very specific cases. A couple could shield nearly 24 million from federal estate and gift tax in 2021 compared to just 10 million in 2011 4 million in 2008 and 2 million 2003.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a. What Is the Unified Tax Credit Amount for 2021. How Might the Biden Administration Affect the Unified Tax Credit.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. The basic exclusion amount for determining the unified credit against the estate tax will be 11700000 up from 11580000 for decedents dying in calendar year 2021. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

5 The Unified Tax Credit You can use the unified credit to shelter your estate from taxation when you die. Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. The 2022 exemption is 1206 million up from 117 million in 2021.

News November 29 2021. The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax. When an estate is below the unified gift and estate tax credit limit there will be no estate tax due at the time of death.

The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. The 117 million exception in 2021 is set to expire in 2025.

2020 Year End Tax Letter For Individuals Bsb

Taking Steps Now Can Help Reduce Your Tax Bite Later Businesswest

Congress Readies New Round Of Tax Increases

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Planning For Year End Gifts With The Gift Tax Annual Exclusion Doeren Mayhew Cpas

2020 New York Resident Estate Taxation Parisi Coan Saccocio Pllc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

San Francisco Planning For The Estate And Gift Tax Sf Tax Counsel

Exhibit 25 1 Unified Transfer Tax Rates Not Over 10 Itprospt

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

What Is The 2021 Vermont State Estate Tax Exclusion Vermont Estate Planning Attorneys

Estate Gift And Generation Skipping Transfer Taxes 2021

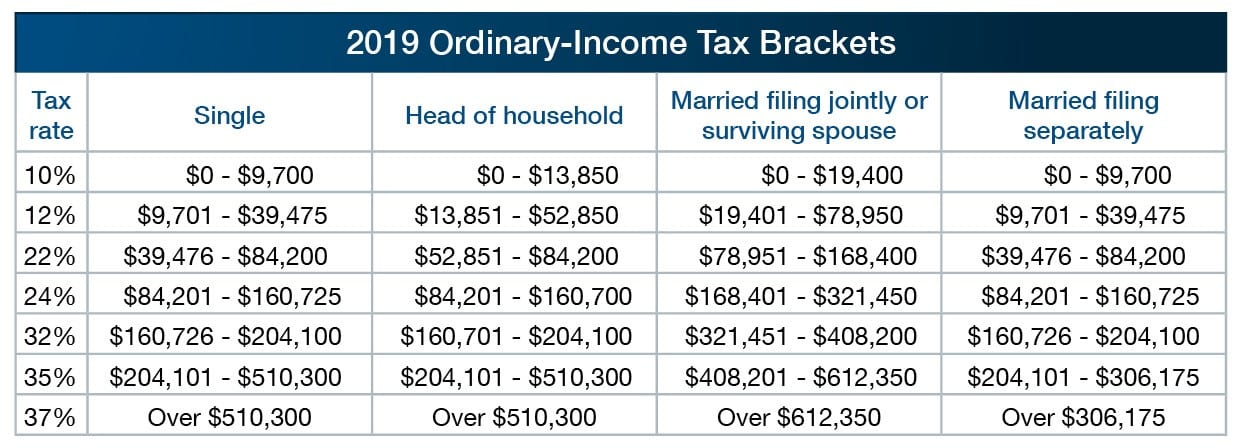

What Do 2019 Cost Of Living Adjustments Mean For You Pya

What Is The Unified Estate And Gift Tax Credit And How Does It Reduce My Gift Taxes

/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)